Cayman still on FATF grey list over AML issues

(CNS): The Cayman Islands remains on the Financial Action Task Force grey list while Nicaragua and Pakistan were removed following this week’s meeting in Paris to review the political commitment made by countries to meet the requirements needed to combat global financial crime. In a statement issued Friday, the FATF said that Cayman, which has just one issue to address to be delisted, still had work to do.

“The Cayman Islands should continue to work on implementing its action plan to address its strategic deficiencies, including by demonstrating that they are prosecuting all types of money laundering cases in line with the jurisdiction’s risk profile and that such prosecutions are resulting in the application of dissuasive, effective, and proportionate sanctions,” the FATF said.

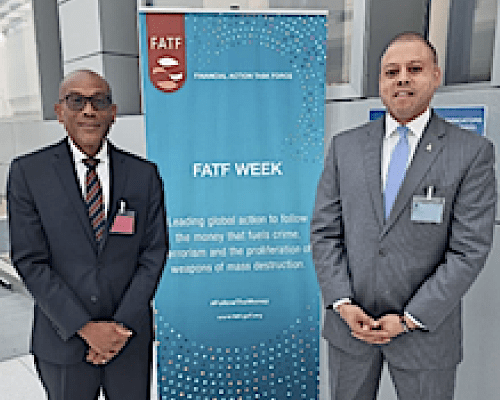

In a press release from his financial services ministry, André Ebanks, who was in Paris this week for the meeting, said that Cayman had satisfied 62 of 63 recommended actions in relation to improving its anti-money laundering and countering the financing of terrorism (AML/CFT) regime.

“The commitment and diligence of both our public and private sectors is earning us a stronger reputation as a global partner that stands firm in fighting financial crime,” said Ebanks. “There is a solid mass of evidence that proves our ongoing commitment to implementing global standards effectively, from our improved policy and legislative framework, to new and enhanced compliance IT systems, to increasing the number of professionals in the public sector who monitor and oversee those compliance systems.”

He said it was becoming clearer globally that the Cayman Islands has a legacy image challenge rather than issues of standards and effectiveness.

“I couldn’t be more proud of the dedication and cooperation from both sectors. I therefore thought it was important to attend the FATF plenary in person, to convey key data points which demonstrate that the Cayman Islands is not the same as depicted from decades ago. It was an honour and privilege to do so,” he added.

While the FATF did find during this plenary that the islands have imposed adequate and effective sanctions in cases where relevant parties do not file accurate, adequate and up-to-date beneficial ownership information, the last issue around the prosecution of money laundering remains and the task force has given the jurisdiction until February next year to deal with that problem.

In the meantime, Cayman remains on the FATF watchlist and also on the European list as the two are linked. When the FATF listed the Cayman Islands in February 2021, as an automatic consequence the EU added the Cayman Islands to its list of jurisdictions with AML/CFT deficiencies in February 2022. However, once the FATF removes the Cayman Islands from its list of jurisdictions under increased monitoring, the EU will initiate its steps to also delist the Cayman Islands.

- Fascinated

- Happy

- Sad

- Angry

- Bored

- Afraid

Category: Business, Financial Services

We are on there for a failure to prosecute cases, let’s be clear. That rests solely with the minister, chief officer and legal folks.

Minister Ebanks didn’t you look Sir Alden squarely in the eye in parliament and say that everything could be done over zoom? What happened? All you do is travel on the govts dime. How about you focus on the things a minister is actually responsible for, instead of meddling in people’s business. But carry on Sir, time longer than rope

Is it really ok that permanent residents of other countries can avoid levels of taxation where they live by sending it here?

Fundamentally, that’s not very cool is it? If you live somewhere for more days than you do not, that should be your home for taxation purposes – you’re driving the roads, access to the airports, defending by the security services, etc, etc all the usual stuff

But you don’t want to pay tax at the level you earn it because you’ve deemed it too high. Not because it is too high (plenty of others are paying it), but because you think its too high.

So just leave. Along with obvious government misspending and all the other rationales, one major issue with creaking infrastructure in huge countries and poverty and failing health systems is lack of resources as tax avoidance takes place

and as to setting up special purpose vehicles to enable non-resident businesses to contract here and avoid liabilites and taxations elsewhere…oh man.

tax avoidance is a massive reason for the global mess we are in. Why do we celebrate people being worth $100BN? let them be worth $50BN, its still a load of money and we’ll tell them they’re great then too

we can’t just print money for ever, at some stage (unless you’re a true MMT and therefore higher than Snoop Dog) the bill comes due…take a look at the news, its coming due.

Enabling tax avoidance is a great thing for the very few who can afford it and a wonderful thing for their accountants and lawyers, but its a dreadful thing for the world.

and count down to the ‘socialist’ triggered…3..2..1..

Well, as an American, you can’t avoid taxes even if you’re a permanent resident here. That’s not very fair either, but then, who said life is fair?

Delaware is the biggest tax haven in the world. Right there on US soil

“Is it really ok that permanent residents of other countries can avoid levels of taxation where they live by sending it here”.

Taxpayers cannot legally do what you are describing, since Mutual Legal Assistance Treaty signed in late 1990s. Cayman has also signed onto dozens of automatic Tax Information Exchange Agreements, USA Foreign Account Tax Compliance Act and regulator to regulator MOUs. This is why tax evasion isn’t advisable , and isn’t a business line for any regulated participants in this jurisdiction.

Actually you can park income in Cayman entities and avoid tax at home for quite some time, even if you are a US citizen. This is in fact a major line of business.

If you are a US citizen, you still have to file an annual income tax return and if you earn more than a certain amount or have investment income over a certain amount, pay taxes on that. Where you “park” those earnings doesn’t matter (unless you lie, which is extremely dangerous since FATCA). You used to be able to avoid paying taxes on business profits earned here until you repatriated it, but that ended with Trump’s tax reform.

As well as the FBAR reporting all your foreign accounts

What on earth are you babbling about? You sound entirely clueless as to how tax works.

The culture at CIMA is so toxic now in that Sr Management many times bully departments to approve licences as they (Sr Management) are pressured by the big law firms. Need new blood at CIMA. No wonder Cayman is on the Grey list.

CILAP-CARA purported (but ultra vires) self-regulatory body for AML monitoring of attorneys that carry out relevant financial business, which was a failed attempt, has contributed, too, because Cayman mislead FATA.

Partners in law firms need to be investigated and prosecuted for allowing criminal breaches of the Legal Practitioners Act and money laundering to happen.

we are place based around tax evasion and money laundering. face facts and move on.

Wrong.

You have clearly never watched The Firm.

Tax avoidance and tax deferral is what Cayman does, and it is legal here and elsewhere.

CIG needs to go after the Crypto operations not registered with CIMA. Major law firms who have no loyalty to this jurisdiction are to blame.

CIG needs to keep a close eye on cryto operators even if they are registered here.

Let’s start with unregistered and at least get them under CIMA supervision. There are many so called “consultants” providing company management services without the proper licence. CIMA is not interested in bring an action against them as it requires actual work and upsetting those in positions of power.

It’s a joke… maybe the reason they’re not fining people enough is because of the over regulation and hoop jumping we have to go through to get a simple employee bank account open, let alone an LP registered with a fund administrator

The EU is not going to allow Cayman into the fold. The UK used to lobby hard for the offshore centres, so Brexit was always going to mean BOTs were going to be blacklisted whenever possible.

Well it helps the EU explain that prejudice when we don’t follow the rules and get grey listed by FAFT, who have nothing to do with the EU. Bottom line – we got ourselves in this fix, not the EU.

PPM implemented certain things, which were nothing more than form over substance, that were ultra vires and were not compatible with our Constitution (particularly incompatible with our Bill of Rights).

Now, as the truth has emerged overtime, such PPM-policies and legislation, which are inappropriate, have been bought by the PACT and now, without doubt, the PACT own them as their own.

It is never to late to do the right thing, however, as here, the longer it takes to do it, the more financially expensive it’s going to get to pay for failures (which I need not elaborate on) and time lost by that could have been better spent doing the right thing.

Let’s see how it all plays out. Hopefully, in the best interests of Caymanians (and residents).

Actually it was the CATF (Caribbean Action Task Force) who made the findings against us. They are but one member of the FATF. I suspect that there was some “crabs in a bucket” mentality here.

Good luck next month with CFATF plenary.

Over 200 “churches” in Cayman that aren’t subject to AML and close to $2Bln in money order transfers a year, just to Jamaica. Works out to over $50k per year per resident Jamaican. Cayman is also host to 17 Crypto exchanges where clients just needs a wallet. Plenty of fishy AML holes in Cayman.

$2 billion being sent to Jamaica every year? Can you share where that statistic came from?

Cayman is home to 17 Crypto exchanges you say? Would love to see your source for that, if you don’t mind.

Will take a few more large delegations heading to Europe to get this sorted out.

Junius- you are so right. It seems like our regulator has just merely gone into the let’s pass the irrational bullying down through the industry. Every legitimate service provider is being pushed to pass absolutely ridiculous amount of policies and manuals and adopt such box ticking approach that the substance is lost. We need clear and transparent rules and regulations. We do not need regulator who at the whim during individual inspection decides (without actually passing a law and educating the industry first) that previously acceptable paperwork is now unacceptable. Whilst at the same time allowing banks who’s trading partners have raised serious money laundering concerns keep on operating.

This is so embarrassing!!

https://en.wikipedia.org/wiki/Global_Terrorism_Index

Lol.

It might be time for some new blood at CIMA, current leadership has been in place since the last century. It is highly unusual for one person to head any government agency anywhere for that long.

Apparentlty staff use the words “number one” to refer to … That say’s it all about the culture there

“Legacy issue”, yes, that’s right.

#blameivan

Cayman will never be removed until it’s financial industry has been destroyed by these entities, Cayman need to wake up and start fighting back against them with the attitude and understanding they have declared eat against the country as nothing will appease them.

Good luck going full rogue without access to an international payments and settlements system.

bitcoin fixes this

Don’t be ridiculous.

As the great Lone Watie once said, “You drink it.”

Do you really believe the world is afraid of the EU and the US anymore, there is now Union Pay and CIPS even Saudi Arabia is applying to be a member of BRICS, shut up with the threats the world is awakening and moving on.

Declared eat? Did you mean war?

Grammarly it seems didn’t allow “war” on that occasion hopefully it does this time around.

FATF is but one of the international bullies, however, that does not mean that it should cause a jurisdiction to bully its own citizens.

When FATF exert pressure on a jurisdiction, like the Cayman Islands, then it is unconscionable for that jurisdiction to transfer the malice to its own citizens, instead we should all work together to solve the problem (not to perpetuate it).

Cayman has still not learned that lesson and, until it learns how to treat its citizens, whilst being under international pressure, problems will be extant and the cycle will repeat itself.

If the Cayman Islands is going to come out on top, where international pressure is bearing down, working in unity with its citizens is the best modus operandi to achieve success.

There are suggestions to get off of the FATF grey-list, which don’t require as much aggression and oppression, provided a blind eye of connivance is not turn to extant wrongdoing.

Until we (as citizens and residents of the Cayman Islands) learn to work together effectively and efficiently, which is a public and private combined effort, we are going to suffer as people in society, who are bullied by CI Government, and as an Island-nation, who are bullied by international bodies/groups.

It is time to break the vicious cycle or, if not, watch the degradation of the socio-economic value become diluted and suffer both domestic and internationally. Hopefully, that can be avoided.

The Cayman Islands is at a crossroads, before things go from bad to worse, and it is hoped that the right decisions and actions are taken to provide solutions, rather than perpetuate the vicious bullying cycle.

FATF is enough of an issue to contend with. Why make it cause domestic turmoil to appease international pressure. If done successfully, this could ease the Hon. Attorney General’s often heard complaint about “AML fatigue”.

Same strategy has been employed for generations. Blame the people for the governments failures and treacherous bureaucrats from foreign countries. But to you, it’s the peoples fault.

What have you been smoking?

Just goes to show that this is a pure political process. Pakistan and Nicaragua were removed from the grey list. OECD/EU/FATF will not be happy until Cayman is out of business.

That’s how you know it’s illegitimate. Plain and simple. The organization is fraud.

Oh yeah? Want to name any money launder prosecutions in Cayman, other than the laughable attempt to tack on money laundering to theft charges to try and massage statistics. When have we ever caught and prosecuted someone for laundering multi million dollar amounts? Never, despite the trillions in transactions that flow through Cayman.

The money doesn’t really “flow through Cayman.” The actual accounts are elsewhere. This is why the prosecutions are elsewhere—where the money and/or its beneficial owner can be seized or arrested.

What a joke really Minister and Mr. Arana

You mean to say Pakistan is more effective than Cayman when it comes to money laundering enforcement… lol … you can’t make this up!!

Imran Khan was banned, but McKeeva allowed to carry on – that’s one apples to apples difference.

@3.58 It does not mean that they were more effective , it just means that they were treated as if they were. You need to understand that neither Pakistan nor Nicaragua are true targets of these people; Cayman.

Someone tell them we already collect more information that the Europeans, the Canadians, UK, and the Unities States. Time to tell them to bugger off.

Well that didn’t go very well, did it?

Seems it did not.

The problem is the FATF have hit on Cayman’s soft spot. We love passing laws and pointing to them as an example of how sophisticated we are. But implementing them and punishing those that break them – a completely different issue.

Passing quite a bit of ultra vires legislation.

Ding ding ding!!!!

I therefore thought it was important to attend the FATF plenary in person, to convey key data points which demonstrate that the Cayman Islands is not the same as depicted from decades ago.

Silly me, I thought that it was just a junket that every politician is entitled to.

Should have sent the young man that is going to college in England. Think he would have been more successful.

A total farce. Cayman could go full Skanwegian socialist with 100% tax and would still be on the list.

Now, instead of catering to predominantly non-Caymanian commercial parties’ interests, it might be time to stop throwing Caymanians, who vote MPs into Parliament, under the bus.

Didn’t Andre have all the answers?

Evidently not.

PPM got us in this mess!

PACT did not do anything to help.

PACT continued it.

Apparently not.

Form over substance approach, which is oppressively irrational and disproportionate, that is discriminatory towards Caymanians is going to be the PACT’s downfall (just like the PPM).

Cayman’s successive administrations have eagerly sought to dwell in the ambiguous but rewarding grey zone of permissible activity, while papering the file with inert legislation and impotent “agencies” and “committees”. There is a large gap between optical compliance and materiality. Look no further than who was allowed to occupy the Speaker chair in the Parliamentary Legislature. Grey List it is.

Cayman did it to itself. Irrational policy in reality, but nice legislation to appeal to form over substance.

What’s the impact on delist? Does that mean Cayman would not be able to trade in euros or impact wire transfers to European banks?

I think this will be a relentless fight and FATF will continually push Cayman into the grey list until Cayman is solely a “Sandals resort”.

Definitely impacts wire transfers to EU.

What a joke – Nicaragua and Pakistan are off the grey list? Both are countries with significant domestic and international terrorist issues. Ridiculous.

Cayman needs to do better.